S corp payroll calculator

Instead S corporations and partnerships pass income deductions credits etc to shareholders and partners as reported on the Schedule K-1 information statement. An S Corp is a corporation thats able to pass its income losses deductions and credits on to its shareholders no separate corporate tax required.

Payroll Calculator With Pay Stubs For Excel

During the Income Tax Course should HR Block learn of any students employment or intended employment with a competing professional tax preparation company HR Block reserves the right to immediately cancel the students enrollment.

. For example in California an S-corporation must pay tax of 15 percent on its income with a minimum annual amount of 800. S Corp Savings Calculator. Quarterly income tax return deadlines.

Benefits of Using a Payroll Calculator. There are many benefits of using a payroll calculator including the ability to estimate your paycheck in advance. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply.

Get 247 customer support help when you place a homework help service order with us. The S Corp Tax Calculator. Use our S Corp tax calculator to see how much money you could save by switching to an S Corp structure.

How an S Corporation Saves You Money. Ask a licensed accountant andor tax advisor and attorney for guidance as you establish how your LLC or S Corp will compensate you for your investments of time money blood sweat and tears. Its possible for S Corps to unfairly avoid payroll taxes by characterizing.

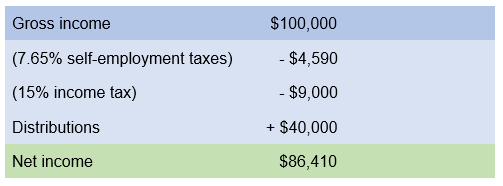

But if your business is taxed as an S-corp youll only pay payroll taxes on your reasonable salary of 70000. Use this handy tool to fine-tune your payroll information and deductions so you can provide your staff with accurate paychecks and get deductions right the first time around. Money that you take out as a distribution is not subject to the 153 percent payroll or self-employment tax whereas your regular salary payments are.

If the S corporation is unable to file by the deadline it can obtain an extension of time to file by filing IRS Form 7004. 2 For a sole proprietor the employee contributions are on the Schedule C and your contributions are an adjustment to income on the 1040. This allows owners to pay less in self-employment tax and it allows owners to contribute to their 401k and health insurance with pre-tax dollars.

An S-corp or S-corporation is a tax status allowing business owners a flexible way to start small and grow. TRUiCs Tax Calculator and S Corporation Requirements. For the purposes of registering for a payroll tax account with federal and state agencies does the company register for payroll tax account as an LLC or an S Corp.

Profit and Distribution. There is a line called Pension retirement and other qualified plans. 1 For an S-Corp all SEP contributions should be deducted on the S-Corp tax return.

As with larger corporations an S-corporation has both start-up and ongoing legal and accounting costs. Starting an LLC and electing S corp tax status is easy. The election of S corporation status allows LLC owners to be taxed as employees of their own business.

A contract worker under a corp-to-corp agreement must own an LLC a corporation or an S corporation. You can use our step-by-step guides to start an LLC with the S corp status yourself or you can hire a service provider like ZenBusiness to do it for you. Use our Free Self-Employment Tax Calculator to predict how much tax youll have to pay based on updated 2018 IRS tax tables and codes.

LLC Calculator to estimate whether electing S corp tax status makes sense. Always remember for both the Sole Proprietorship and the S Corp all profits pass through to your personal taxes. Skip To The Main Content.

This is a tax levied on the salary of everyone in your business even if you are self-employed. Fast easy accurate payroll and tax so you save time and money. CTEC 1040-QE-2662 2022 HRB Tax Group Inc.

After electing S corp status an LLC owner uses profits to pay salaries and distributions to owner-employees. If you have an existing LLC visit our How to Convert an LLC to S Corp guide. S Corporations reduce your taxes by lessening the amount of payroll or self-employment tax you pay.

Small Business Payroll 1-49 Employees Midsized to Enterprise Payroll 50-1000 Employees Time Attendance. For businesses that qualify electing S-corp status could lead to important tax benefits. When people casually refer to a corporation theyre likely describing the most common and.

Its a challenge to manage employees calculate their hourly paychecks and process your payroll all while running a small business. If an LLC owner forfeits a salary he or she. It typically takes 2 minutes or less to run payroll.

Updated with current IRS withholding information for 2018. Wages deductions and payroll taxes completed automatically. The student will be required to return all course materials.

SECA vs S Corp FICA Payroll Taxes. Sole Proprietors and partnerships are covered by an employment tax called SECA while S Corp owners pay into a similar program called FICA. Steps to Forming an LLC and Electing S Corp Status.

The S Corporation tax calculator below lets you choose how much to withdraw from. There are two parts of this tax that paid by the employer and that paid by the employee. For some LLCs the cost of hiring a payroll service and bookkeeper would outweigh the financial tax advantages of electing S corp tax classification.

Similar to a 1099 independent contractor the contracted worker under this arrangement is responsible for all taxes which will be at a higher rate because of the businesss obligation to pay into Social Security and payroll taxes like FICA. Calculating payroll deductions doesnt have to be a headache. The shareholders who pay tax on the S-corp income are generally subject to the same deadlines the IRS imposes on individual taxpayers which in most cases is April 15 every year.

Explore our full range of payroll and HR services products integrations and apps for businesses of all sizes and industries. This tax is not required for sole proprietors. S Corp is going to pay salary to the single shareholder.

With Collective you get accounting monthly bookkeeping and financial statements payroll support administration S Corp formation annual tax filings and quarterly tax support. For 2018 I filed 2553 to convert existing California LLC to S Corp for a single owner shareholder. The other 30000 will still be subject to income tax but not Medicare or Social.

Our guide will help you get started. However they are treated differently once they get there. These LLCs would be best to operate as a default LLC.

Business income tax returns federal and states Individual income tax returns federal and states. The business must make at least 60000 in earnings be able to cover a reasonable salary and have at least 20000 in annual distributions for the S corp election to make financial sense. In some states S-corporations must also pay additional fees and taxes.

Access to our award-winning US-based customer service team. S corporation and partnership returns are pass-through returns because S corporations and partnerships usually dont pay income tax at the business level. Employment Payroll and Self-Employment Tax.

Just include it there. Use our S Corp vs.

Llc Taxes Payroll Taxes Llc Taxes Payroll

Payroll Calculator Template Free Payroll Template Payroll Templates

Payroll Calculator With Pay Stubs For Excel

S Corp Vs Llc Everything You Need To Know

Sole Proprietorship Vs S Corp Tax Spreadsheet For Internet Publisher And Youtuber Which Will Save More Tax Money Techwalls

How To Do Payroll In Excel In 7 Steps Free Template

S Corporation Tax Calculator Spreadsheet When How The S Corp Can Save Taxes Vs Sole Proprietor Youtube

Cash Management Payroll 101 What Every Small Small Business Community Cash Management Community Business Payroll

S Corp Payroll Taxes Requirements How To Calculate More

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

Payroll Calculator With Pay Stubs For Excel

The Basics Of S Corporation Stock Basis

Payroll Calculator Templates 15 Free Docs Xlsx Pdf Payroll Template Payroll Payroll Checks

How Is Reasonable Compensation Calculated S Corporation Owner W 2s Youtube

Salehaamir322 I Will Provide Swedish Tax Consulting For 60 On Fiverr Com Tax Consulting Consulting Tax

How To Run Payroll For An S Corp Collective Hub

How To Calculate Your Real Cost Of Labor Remodeling